Key events

Filters BETA

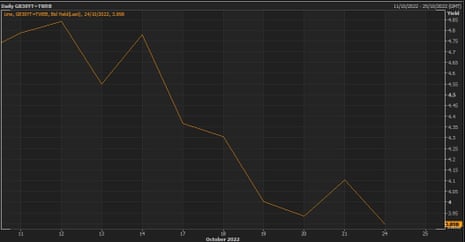

Not a lot of change on UK government bond yields either since their initial drop this morning.

The yield – or interest rate – on 10-year UK government bonds is still around 3.8%.

A lower yield signals confidence in the UK’s ability to repay its debts.

Meanwhile, the yield on the 30-year gilt is hovering at similar levels.

The pound is in negative territory versus the US dollar, down around 0.1% at $1.129.

Versus the euro, it has pared gains to trade around 0.15% higher at €1.148.

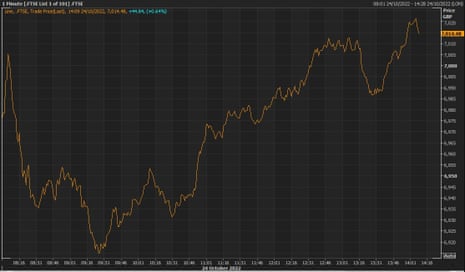

FTSE 100 hits session high as Sunak set to become PM

While markets have largely priced in Sunak’s victory, the FTSE 100 has risen to its highest level this session.

The blue chip index is up nearly 0.7% at 7015 points.

With Sunak now set to become UK prime minister, former Bank of England rate setter Danny Blanchflower says the hard work is just beginning:

Ok now the fun really starts we await to see whether there are spending cuts in a recession…as pmis and retail sales collapse,,,,

— Professor Danny Blanchflower economist & fisherman (@D_Blanchflower) October 24, 2022

Penny Mordaunt withdraws from Tory leadership race

Back to to the eurozone purchasing managers’ index, the survey which showed that business activity across the bloc had fallen at the fastest pace in two years this month.

Saloman Fiedler, an economist at Berenberg, says the data shows a eurozone recession is “underway”:

The gas supply shock after Russia’s invasion of Ukraine and the resulting exorbitant energy prices are pushing Europe into recession this winter.

The downturn in the UK will likely be deeper and may have started earlier (in Q3) than in the Eurozone (likely Q4).

He notes that in most eurozone countries, PMIs are below 50, which is the threshold that separates contractions from expansions. Except France:

The sole exception is France, where resilient, albeit slowing, business activity in the services sector is still keeping the composite index teetering on the edge – but most likely France will tip over into recession as well.

In contrast, industry and gas dependent Germany is doing worse than its European peers.

The PMI survey paints a similar picture across countries: Input price inflation remains very high. Energy prices are the major driver, but other costs, including wages and financing costs, are rising markedly as well

High input costs are leading to ongoing output price inflation, as firms pass on costs to consumers. This likely contributes to the declining volumes of new business for firms.

The one saving grace is high levels of employment across the bloc:

Despite the bleak near-term outlook, employment growth remains relatively robust, which could support the economic recovery once Europe has made it through the painful winter.

Brent crude futures have slipped 1.3% to $92.33 per barrel after Chinese data showed a drop in demand in September.

China’s September crude imports were 2% lower compared to a year earlier, at 9.79m barrels per day, according to customs data released on Monday.

It adds to a mixed picture in China, which also revealed a 3.9% rise in GDP for the third quarter. While that was above analyst forecasts for a 3.3% rise, it is below government targets of 5.5%.

Just a little over an hour until markets open in the US and futures are pointing to a positive start for American stocks:

Charlotte Sallabank, a partner and head of tax at lawfirm Katten UK, says Rishi Sunak is unlikely to tinker with existing economic plans set out by current chancellor Jeremy Hunt if he wins the Tory leadership race and ends up in Number 10:

As Jeremy Hunt’s mini budget effectively restored the fiscal policy to that which Rishi Sunak had proposed in his last budget as Chancellor in March 2022, Sunak is unlikely to make many changes to fiscal policy.

He may set a date for the reduction of income tax basic rate to 19% – in his March budget Sunak set it to reduce to 19% on 6 April 2024 and in his leadership battle with Liz Truss in August he promised a reduction of 1% in 2024 with it reducing to 16% by the end of the next parliament (around 2029, potentially).

Jeremy Hunt, in his reversal of Kwarteng’s IT basic rate reduction, did not set an anticipated date for a reduction, just that it would be under review.

Sallabank says that Sunak will “hopefully” provide further stability by keeping Hunt in Number 11 Downing Street.

She adds that it could mean the Treasury could then turn attention to other issues that were buried amid recent chaos:

After such a rapid turnaround in Chancellors and PMs hopefully Sunak will keep Hunt in post.

Hopefully, assuming his appointment and policies bring back stability to the market, this will allow Treasury and HMRC to focus on some of the other tax issues that were in focus before Liz Truss became PM and whilst Rishi was Chancellor (e.g. re-domiciliation of companies, changes to the investment manager exemption to encompass crypto assets and various other consultations that have lost airtime in all the upheavals).

It would be good, too, to see the Office for Tax Simplification be given a reprieve.

The FTSE 100 has bounced back into positive territory, just as the pound turns negative against the dollar (a move which is positive for multinational firms that make a chunk of profits overseas, since a weaker pound boosts their foreign income).

The FTSE 100 is up 0.5% at around 7006 points.

The pound meanwhile is down 0.2% against the US dollar at $1.128 but is still trading nearly 0.3% higher versus the euro at €1.149.

Parliament launches inquiry into pensions crisis that led to £65bni ntervention

The Work and Pensions Committee has announced an inquiry into the pensions market crisis, in which defined benefit schemes involved in liability driven investments (LDI) were put under severe pressure after the mini-budget.

LDI funds were blamed for magnifying the recent market turmoil, which was triggered by fears over the government’s mini-budget and resulted in a severe drop in UK bond prices.

The fall triggered collateral calls on pension funds’ hedging contracts, forcing them to sell assets at speed to raise cash, but resulting in a further drop in prices.

The Bank of England stepped in with an emergency two-week, £65bn bond-buying programme to halt the rout.

Springboard data: Shopping demand drops amid cost of living squeeze

Shopping across the UK fell further last week, dropping 2.3% from a week earlier.

Retail experts at Springboard, which produced the data, said the drop “indicates consumer nervousness” amid the cost of living crisis and recent political turmoil.

The drop was experienced across high streets (down 3.3%), retail parks (down 1.5%) as well as shopping centres (down 0.7%).

Scotland was the only region where footfall rose, rising 1.1% overall. The biggest drop was seen in the West Midlands, where footfall tumbled 5.9%

Diane Wehrle, Springboard’s insights director, says:

There are several factors at play in terms of what is driving consumer activity; however, the most evident is the squeeze on household incomes as a consequence of inflation and increased mortgage rates.

This, mixed in with the current political uncertainty, inevitably makes consumers cautious and then rail back on shopping trips.

She said the data has likely been compounded by the start of half-term holidays, which may mean that shoppers deferred some of their trips last week:

Footfall typically rises in the week of school half term as families visit retail destinations for group shopping trips and days out, so footfall this week will be a good barometer of current consumer sentiment and behaviour.

Martin Beck, chief economic advisor to the EY ITEM Club, says the poor business activity survey results – as highlighted by the purchasing managers’ index (PMI) – were “no surprise”.

Beck explains that intense cost of living pressures and mounting political uncertainty are to blame for the October reading.

Business activity across the services sector fell further to 47.5 from September’s 50.

Meanwhile, manufacturing activity fell to 45.8 from 48.4 a month earlier.

A reading below 50 indicates a contraction in activity.

However, Beck says there a silver lining in the PMI data:

The silver lining suggested by the PMIs was a decline in the surveys’ measure of cost and price pressures.

Overall input cost inflation faced by private sector firms eased to its lowest since September 2021, albeit remaining high by historical standards, and growth in prices charged moderated to a 14-month low.

Furthermore, any other signs of economic weakness and a smaller rise in inflation could reduce the size of the Bank of England’s interest rate rise next week.

More evidence of economic weakness, combined with signs of less heated inflationary pressures, should, all else equal, tone down the MPC’s appetite to raise interest rates substantially in its November meeting.

The reversal of almost all the mini-Budget’s tax cuts and the possibility of further fiscal tightening in the forthcoming fiscal statement point in the same direction.

The EY ITEM Club now expects the MPC to raise rates by 75bps in November, a position to which retreating market rate expectations (down from a predicted rise of 150bps in late September to below 100bps at present) are moving closer.

30-year gilt yields hit 3-week lows

The cost of UK government borrowing continued to fall this morning.

It comes as the yield – or interest rate – on the 30-year UK bond dropped to levels last seen on 3 October.

The yield on the 30-year gilt is currently around 3.9%.

Yields move inversely to bond prices, and a lower yield suggests investors see less risk that a government will default on their debts.

Pound pares gains against US dollar

The pound has lost a bit of strength against the US dollar, and is now nearly flat at $1.1311.

However, it remains nearly 0.6% higher against the euro at €1.1531, despite lower PMI readings across both the UK and eurozone this morning.

Joshua Raymond, director at online investment platform XTB says that Sunak’s PM prospects are notably reducing the prospect of a general election – despite calls for a country-wide vote by opposition parties.

However, he said the pound’s gains will be tempered by the fact that Sunak’s economic plans – and whether they’ve evolved since the summer – remain a mystery:

The likely arrival of Rishi Sunak as new PM helps to remove a large degree of uncertainty from the markets.

It lowers the possibility of a general election in the near term and with a strong number of MPs backing Sunak, it also reduces the chance of open hostility amongst Tory backbenchers, paving the way for a smooth transition and management of his fiscal agenda.

That will ease market tensions but it’s likely investors will wait to hear from Sunak what his financial policies will be to shore up the black hole in the UK budget, as frankly we’ve not heard much from Sunak since his electoral loss to Truss.

And it’s this aspect – alongside the small risk of a surprise jump in votes to Mordaunt – which is keeping the pound back from making further gains.

Credit Suisse has reached a settlement over yet another scandal – this time over a case launched by French prosecutors who accused the bank of helping people avoid wealth taxes.

The alleged scheme took place across several countries between 2005 and 2012, according to prosecutors.

The fine is related to allegations railed against its private bank, which helps wealthy people and businesses manage their money and investments.

Switzerland’s second largest bank will now pay €238m to settle the case, which means it has not admitted wrongdoing.

It comes ahead of Credit Suisse’s Q3 results due on Thursday, when it is set to update on its strategic plan and unveil thousands of job cuts as it slims down its investment bank and non-core businesses, in favour of a pivot towards its wealth management business.

Credit Suisse said in a statement on Monday:

Credit Suisse announces today that it has reached a settlement with the settlement with Parquet National Financier (PNF) to resolve a legacy matter in relation to an investigation into historical cross-border private-banking services.

The settlement provides for a public interest fine comprising a profit disgorgement of €65.6m and the payment of an additional amount of €57.4m. Further, Credit Suisse will pay €115m to the French State as damages.

The settlement does not comprise a recognition of criminal liability. The bank is pleased to resolve this matter, which marks another important step in the proactive resolution of litigation and legacy issues.

Commenting on the dismal UK PMIs, Jeavon Lolay, head of economics and market insight at Lloyds, says:

Firms are increasingly feeling the strain of economic headwinds.

With a jump in the base rate looking likely and tax rules toughened, they will now be calculating the long-term fallout of a tumultuous month for the country.

Inflationary pressures remain particularly acute in terms of labour. Increasing wage demands from existing workers combined with a shortage of available staff is pushing these costs up rapidly.

This is restricting recruitment, pushing prices higher and limiting investment that might support growth as the economy recovers.

There is some hope, however, that the recent drop in the value of the pound against foreign currencies will improve the prospect for export demand. Lolay adds:

Manufacturers, who are seeing input costs continue to climb despite some easing in supply chains, will hope that the relative weakness of the pound will at least give exports a welcome boost.

Retailers and consumer-facing services would traditionally be eyeing the fourth quarter as an opportunity to bolster sales. But with buyer confidence falling and household budgets shrinking, their Christmases may not be as merry as they are hoping.”

UK business activity falls to lowest level since January 2021

UK business activity contracted for a third month in a row in October, and fell to its lowest level since January 2021, signalling that the UK could be on course for a deep recession.

That is based on the latest set of UK PMIs, with the composite PMI giving a reading of 47.2 compared to 49.1 in September.

Economists had expected a reading of 48.1.

Flash October PMIs:

Composite 47.2 (exp 48.0, prev 49.1)

Services 47.5 (exp 49.0, prev 50.0)

Manufacturing 45.8 (exp 48.0, prev 48.4)— Simon Harvey (@_SimonHarvey) October 24, 2022

When coupled with the eurozone data we received this morning, it is not painting a pretty picture for Europe’s economic prospects:

Pretty ropey European flash PMIs this morning.

🇩🇪 not doing very well at all, 🇬🇧 not looking too hot either. 🇫🇷 doing better than both, but not exactly going great guns. pic.twitter.com/tp2FKz3bt3

— Andy Bruce (@BruceReuters) October 24, 2022

https://www.theguardian.com/business/live/2022/oct/24/pound-gilts-bond-economy-rises-chancellor-rishi-sunak-pm-business-live

![WordPress database error: [You have an error in your SQL syntax; check the manual that corresponds to your MariaDB server version for the right syntax to use near ‘%20+%20thisValue3%20+%20 where ID_P=’%20+%20thisValue2%20+%20” at line 1]SELECT * FROM players_%20+%20thisValue3%20+%20 WHERE ID_P=’%20+%20thisValue2%20+%20’Stats Players – Tennis Tonic](https://tennistonic.com/wp-content/uploads/2019/04/Facebook-default.jpg)